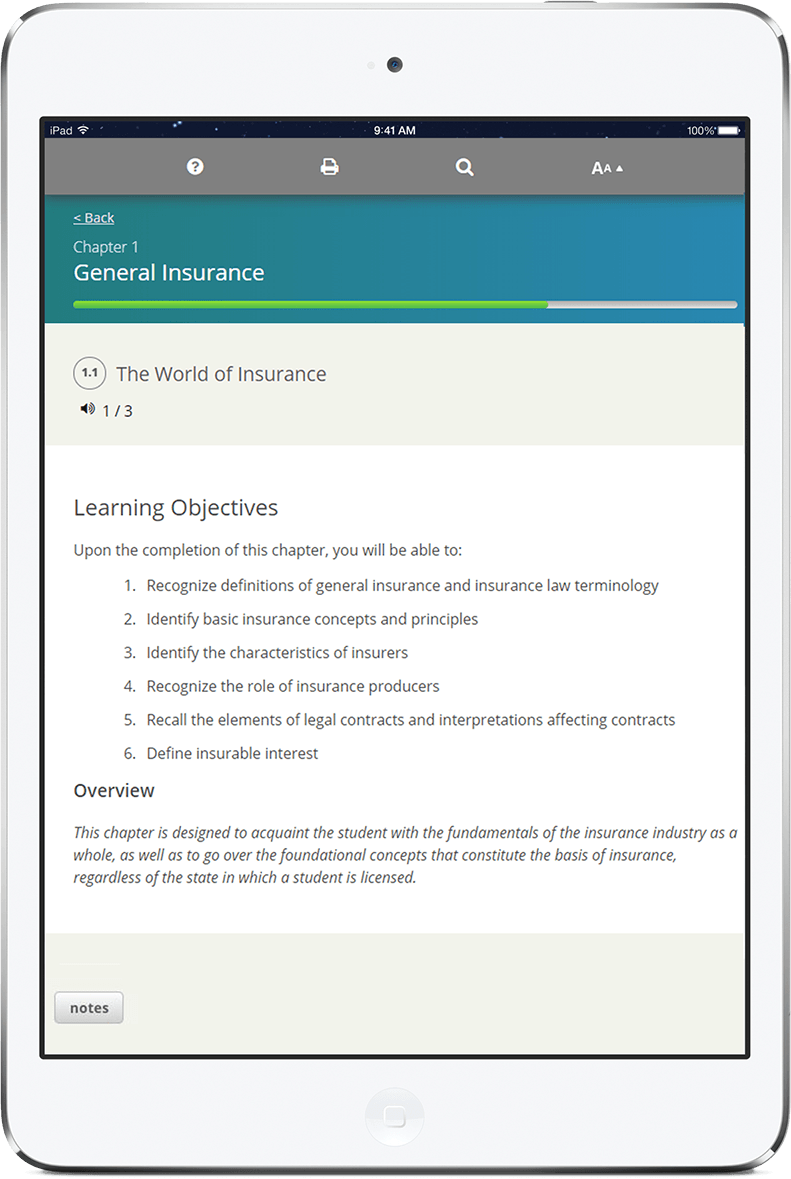

What will I learn?

Property insurance is designed to protect against the financial loss an individual or business suffers upon the damage to one's property,

including the structure of a building or home and personal or business content.

Casualty, or liability insurance, protects an individual or business against a legal liability, or obligation to pay a sum of money for

damages to another person. These types of losses are typically a result of negligence or unintentional harm, including bodily injury or

property damage, to someone other than an insured. A licensed property and casualty insurance professional specializes in assessing a

client's needs and identifying a full range of insurance products to protect clients from suffering financial ruin if they were to pay

for such losses out-of-pocket. Property and Casualty insurance consultants charge a specific fee to research insurance policies, answer

questions, provide advice and make recommendations to clients.

To become licensed as a property and casualty insurance consultant, you will need to demonstrate entry-level knowledge of the industry

by passing a state licensing exam. This course will deliver the content needed to successfully complete the education and examination requirements.

Testable topics include:

Personal property policies - homeowners and dwelling, personal auto, personal umbrella, commercial property,

commercial general liability, business owner's policy, commercial auto, crime, surety, workers' compensation, farm insurance, and

commercial umbrella coverage. This course also provides an overview of general insurance and contract concepts, basic insurance

terminology, covered perils, the policy structure, conditions, exclusions, additional coverages, applicable endorsements, policy limits,

and state-specific regulations based on the state where you are applying for a license.