What will I learn?

Personal lines insurance is written specifically to cover losses of personal property, such as a home or dwelling, renter's insurance,

personal belongings, physical damage to a personal auto, and personal legal liability (casualty losses) for bodily injury or property

damage caused by the actions of a covered insured arising from or as a result of the ownership of a home, auto, or boat.

A licensed personal lines insurance professional specializes in assessing a client's needs and identifying a full range of insurance

products that provide coverage for property and casualty losses that are not business-related.

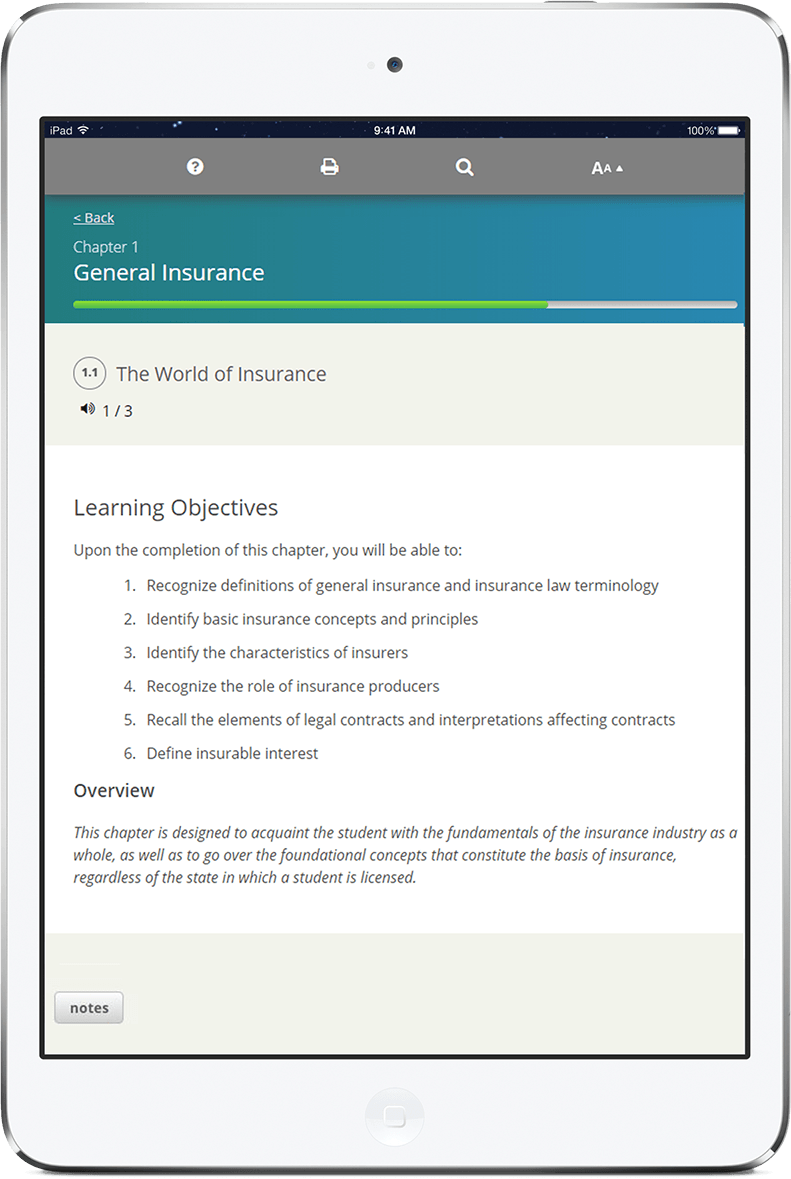

To become licensed as a personal lines insurance producer, you will need to demonstrate entry-level knowledge of the industry by passing a state

licensing exam. This course will deliver the content needed to successfully complete the education and examination requirements.

Testable topics include:

Types of personal insurance policies - homeowners, dwelling, property, auto, umbrella, general insurance and contract concepts, basic insurance terminology, covered perils, the policy structure, conditions,

exclusions, additional coverages, applicable endorsements, and policy limits.